Open topic with navigation

FX Portfolio - Virtual FX Position

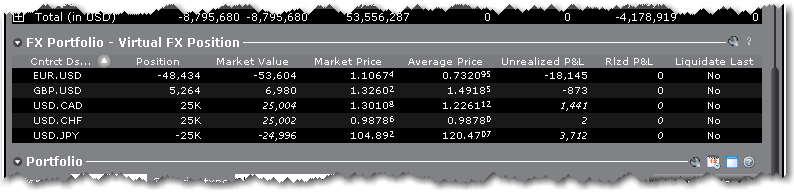

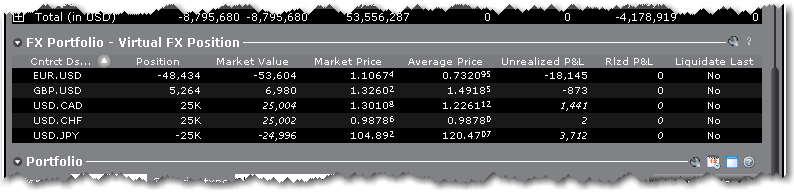

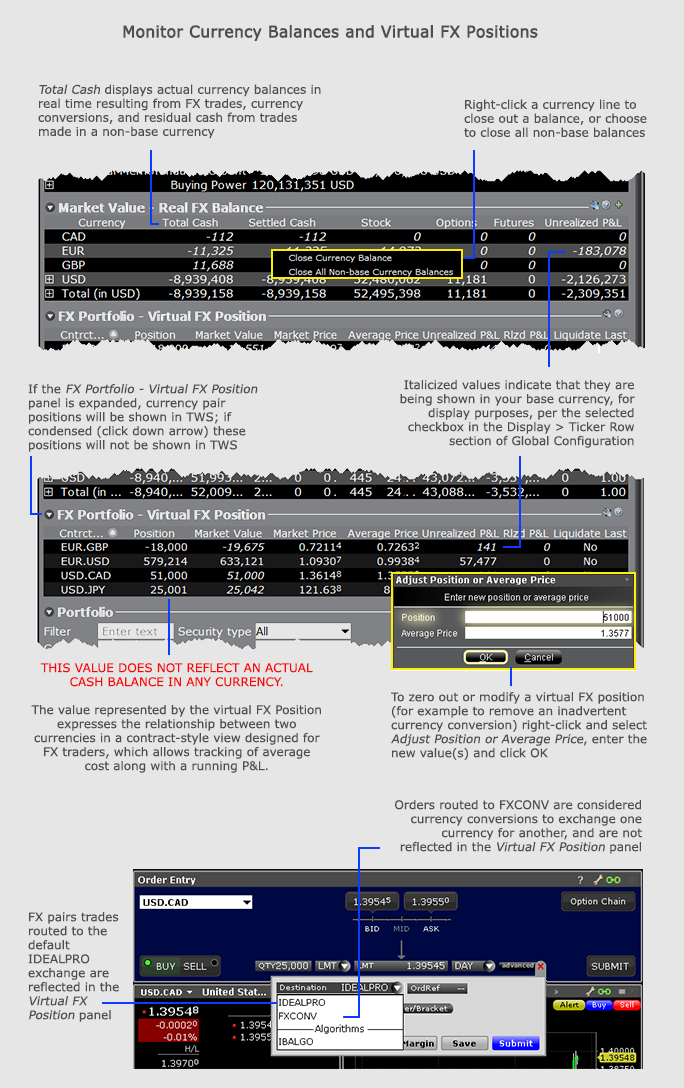

This section is designed to show activity for currency pair trades for FX traders so that they can track average cost and running P&L on their currency trades. However the "Position" value may reflect the sum of trades executed in the FX market along with currency conversions to change non-base funds into your base currency.

Consequently these “virtual” positions do not necessarily reflect an actual cash balance in any currency.

For actual, real-time currency balance, check the Total Cash field of the Market Value section.

- To avoid having currency conversions reflected in this panel, use the FXCONV destination on the order line.

- When the FX Portfolio panel is displayed, currency positions will also be displayed in the trading window. To remove currency positions from display, condense the FX Portfolio panel by clicking the arrow to the left of the panel title.

Watch a short video that explains our dual FX display.

Watch a short video that explains our dual FX display.

|

Parameter

|

Description

|

|

Contract description

|

Symbol and description.

|

|

Exchange

|

An exchange on which the pair trades. This may not be the executing exchange for the trade.

|

|

Position

|

The sum of trades executed in the FX market for the selected currency pair.

|

|

Unsettled Position

|

Unsettled currency trades.

|

|

Currency

|

Currency used to buy/sell the FX pair.

|

|

Market Value

|

(Position) x (market price).

|

|

Market Price

|

Real-time price of the position.

|

|

Average Price

|

Average price per contract.

|

|

Unrealized P&L

|

The difference between the trade price and the market price times position, including commission.

Example: BUY 20,000 EUR.USD @ 1.54390

Trade Price = 1.54390

Market Price (current price) = 1.54385

1.54390 – 1.54385 = .00005

.00005 X 20,000 = 1

+ 2.5 commission = -3.50 Unrealized P&L

|

|

Realized P&L

|

Realized profit & loss for the pair.

|

|

Liquidate Last

|

Last liquidation "Yes" or "No" tag. If set to "Yes" this position will be put at the end of the queue to liquidate last in the case of margin requirements. To set, use the right-click menu on the desired position.

Note: While customers have the opportunity to pre-request the order of liquidation in the event of a margin deficiency in their account, such requests are not binding on IB. In the event of a margin deficiency in customer’s account, IB retains the right, in its sole discretion, to determine the assets to be liquidated, the amount of assets liquidated, as well as the order and manner of liquidation. Customers are encouraged to consult the IB Customer Agreement and the IB Disclosure of Risks of Margin Trading for further information.

|

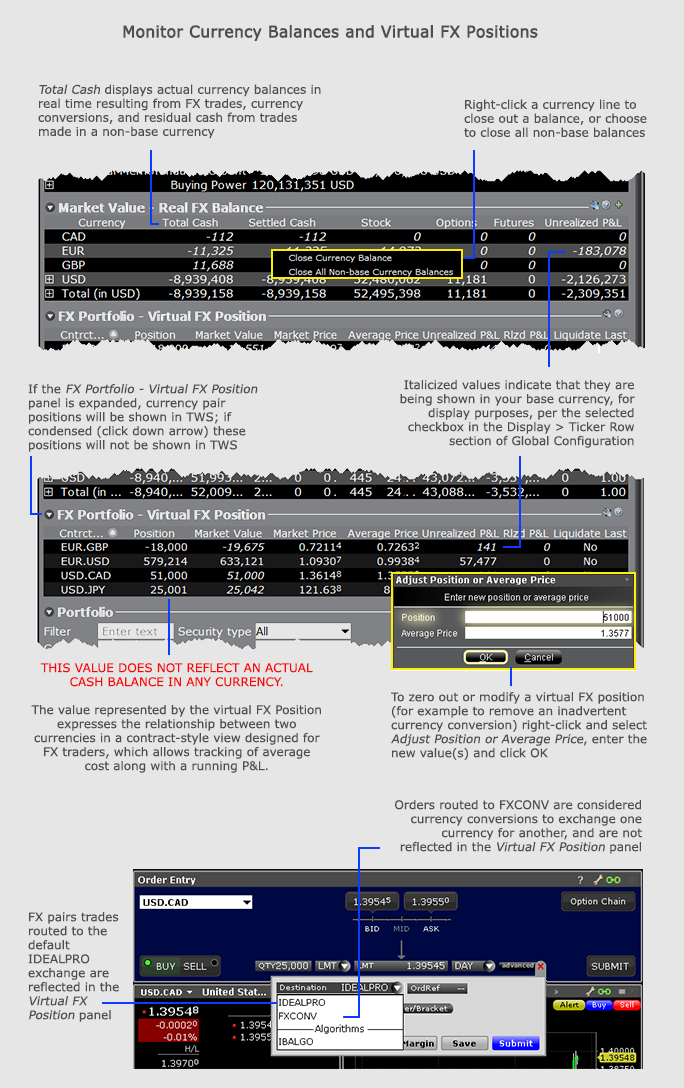

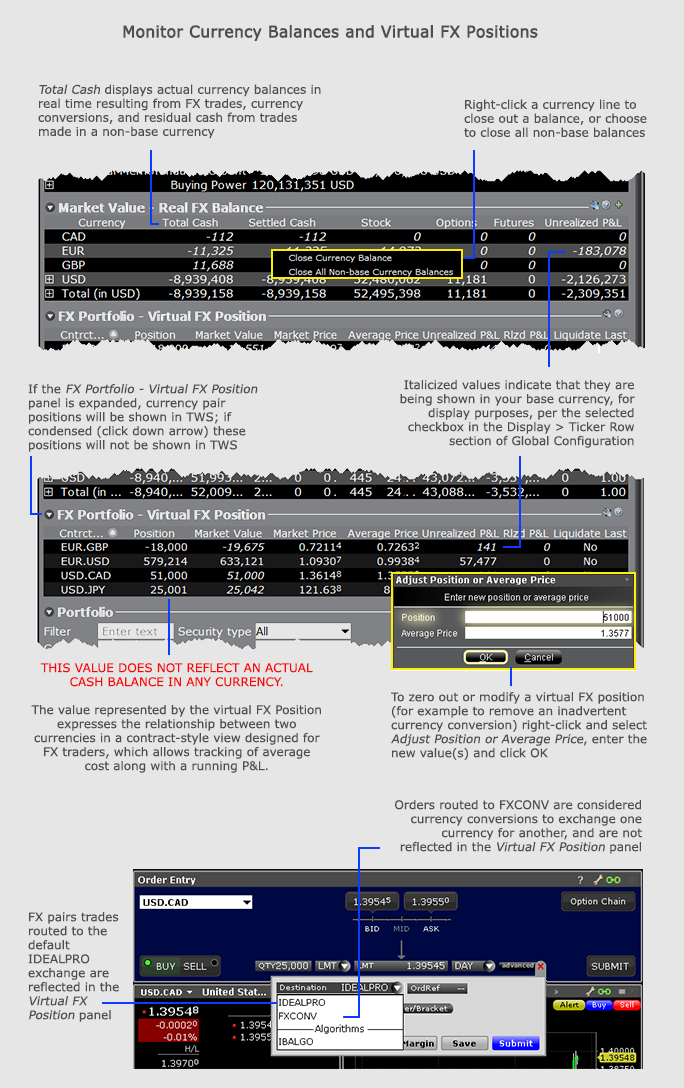

TWS FX Dual Presentation

In TWS, IB presents currency/FX position data in two different areas of the account window. We separate out your actual currency values, which may result from FX trades, conversions, or trading products in another currency, from your direct FX pair trading activity.

Market Value - Real FX Balances

Your account’s actual currency balances are shown in the Market Value – Real FX Balances section of the account window.

FX Portfolio - Virtual FX Position

The FX Portfolio section displays your FX trading activity in currency pairs that is helpful for FX Traders as it allows tracking of a running P&L and average cost. But, it may also reflect “indirect” FX currency conversions designed to close out a non-base currency balance. This view MAY NOT reflect your actual cash balance in any currency. To manage actual currency positions, refer to the Market Value - Real FX Balances section of the account window.

Automated FX Transaction Decision

When you submit an FX order, TWS will attempt to identify whether you want an FX pair trade or a currency conversion, based on your positions and balances, and will ask you how you want the currency trade to be considered. If you elect “Currency Conversion,” TWS will create the order to reflect this objective. You submit the order manually, and when the order fills your virtual position in the FX Portfolio section will not be affected. Previously, conversions would affect the virtual position and your only option was to manually adjust the position and cost to negate the completed conversion.

If you prefer to let TWS make this determination without displaying the confirmation box, check Let TWS make this determination automatically in the future at the bottom of the confirmation box. When you activate this feature, FX trades will display FXCONV as the Destination. You can change the destination on a per-order basis by selecting IDEALPRO. To enable the message again, activate it from the Messages section of Global Configuration. Note that the order will not be transmitted automatically.

Watch a short video that explains our dual FX display.

Watch a short video that explains our dual FX display.