The Pegged to Market volatility order for options pegs or matches the starting price of the order to the opposite side volatility. For example a buy order (for both puts and calls) will peg to the volatility ask and a sell order (for both puts and calls) will peg to the volatility bid.

This order requires a positive offset to the volatility.

Note: To see bid/ask volatility instead of prices, open the VolatilityTrader from the Trading Tools menu.

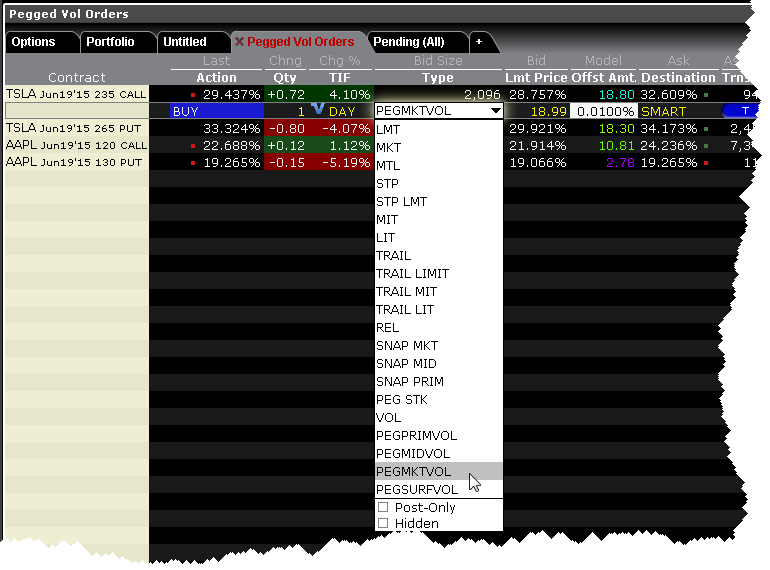

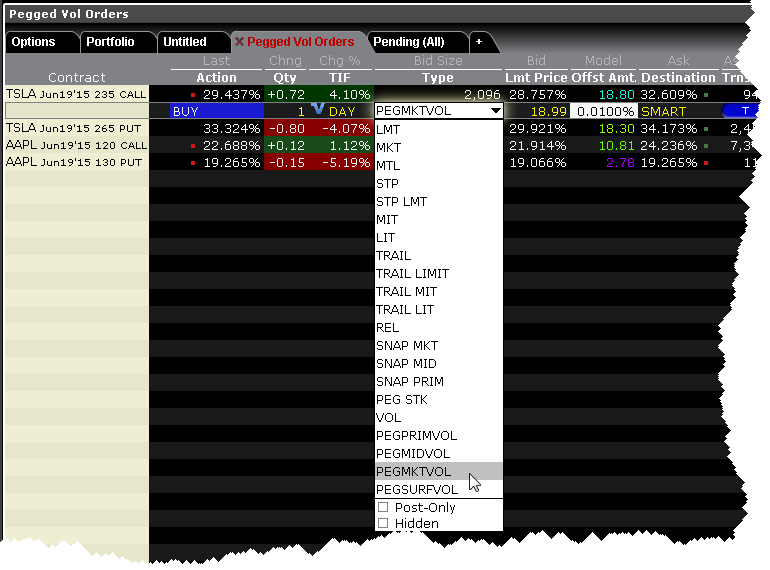

To create a Pegged to Market Volatility Order

1. From the ticker line for an option, click the bid volatility to create a sell order, or the ask volatility for a buy order.

2. From the Type field select PEGMKTVOL.

3. Define a positive offset amount. The offset makes the order less aggressive. For a buy order the offset is subtracted from the bid. For a sell order the offset is added to the bid.

4. Specify other order parameters as needed, including Continuous Update, Reference Price etc.

5. Click Transmit to submit the order.