Open topic with navigation

Define Algo Conditions

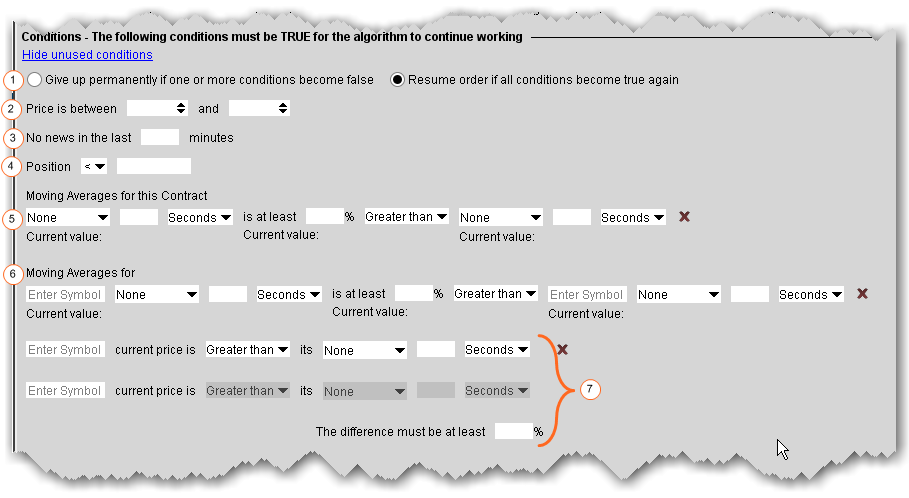

Note that the more conditions to be met, the more difficult it may be for your order to completely fill or to fill according to schedule.

All of the conditions are optional, but if you elect to set a condition, any unfilled fields in the definition become mandatory and are shaded pink.

To clear the values from a condition, click the “x” at the end of the line. The “x” only appears when you have entered data in a field.

Numbered descriptions below correspond to the numbered fields in the image above.

- Specify whether you want untrue conditions (when set) to permanently stop the algo, or to stop it temporarily and resume if/when conditions become true.

- Define a range within which the instrument price must stay for the order to continue working.

- Ensure that the price movement will not be affected by news stories by entering a value in minutes. Until there has been no news for your defined time period as the algo will not work. News is monitored by the news suppliers you have set up in TWS, including Google News, Yahoo! Headlines and the Reuters subscription service.

- Specify that your position, as reflected in the Account window and Position column, must be greater than or less than a specified value. This acts as a floor or ceiling for the position. Not only will TWSnot place the order if the Position condition is violated, but it will not fill any order that would leave it violated.

- Moving averages for this contract - Define moving average criteria for the current instrument . Specify that the current instrument ’s: moving VWAP, moving average, exponential moving average or last over the past [specified time period] is at least a [specified percent] greater than or less than another moving average (for the current instrument ) over [specified time period]. To clear the values, click the ‘x’ at the end of the line.

- Moving averages for - Compare two moving averages, which could be for the same instrument or for different contracts, for the same time period or for different time periods. Specify the underlying, and then set values as in #4 above. To clear the values, click the ‘x’ at the end of the line.

- These three fields work together to compare the change in price of two stocks over a specified time period, based on the difference between the stock’s price and its moving average. The algo completes the calculation based on your inputs. To clear the values, click the ‘x’ at the end of the line. Enter a percent value difference that must be met between the two stock calculations.