Open topic with navigation

Stress Test Report

The Stress Test report lets you see the change in the Profit and Loss (PNL) of your positions if the underlying price of each of your positions declines by 3%, 5%, 10%, 20% and 30% and independently increases by 3%, 5%, 10%, 20% and 30%.

Who can access the Stress Test page?

Who can access the Stress Test page?

You can access this page if you are a(n):

- Individual, Joint, Trust or IRA Account User

- Small Business Account User

- Friends and Family Group Master or Client User

- Advisor Master User Individual

- Advisor Master User Organization

- Advisor Client User Individual

- Advisor Client User Organization

- Proprietary Trading Group Master User

- Proprietary Trading Group Sub User

- Broker Master User (master account only)

- Broker Fully Disclosed Client User

- Broker Fully Disclosed Client User Organization

- Investment Manager Master User

- Fund

To generate a Stress Test report

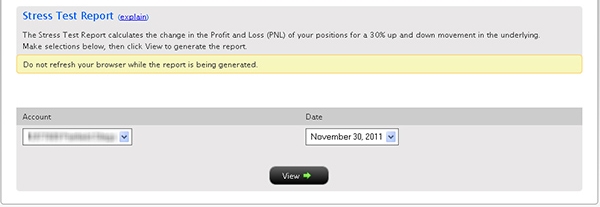

- Click Reports > Risk > Stress Test.

If you have a multiple account structure such as an institution account or multiple linked accounts, use the Account Selector at the top of the page to select an account on which to report.

The Account Selector is closed once you select an account. To change the selected account, click the tab to open the Account Selector, and then click a different account.

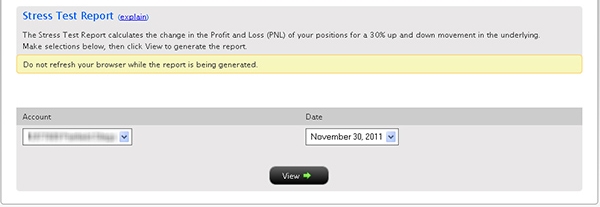

- In the Date field, select the date for the report.

- Click View to generate the report.

Using the Stress Test Summary Report

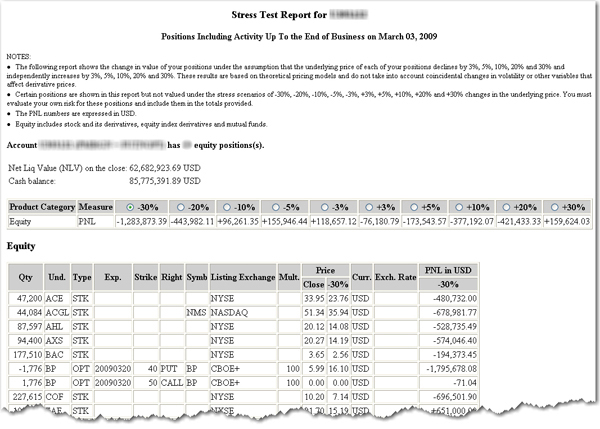

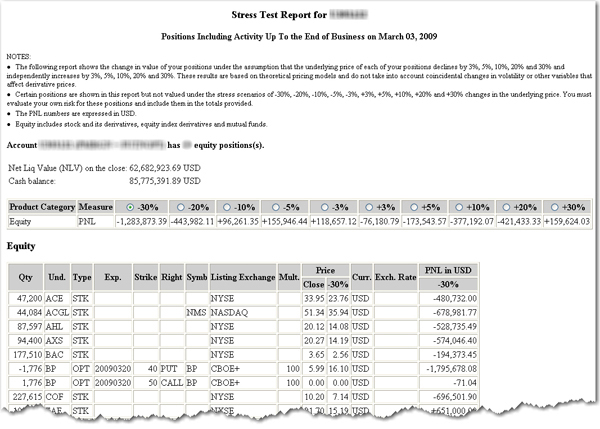

The Stress Test Summary report lets you see the change in the PNL of your positions if the underlying price of each of your positions declines by 3%, 5%, 10%, 20% and 30% and independently increases by 3%, 5%, 10%, 20% and 30%. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices.

The report shows:

- The Net Liquidation Value (NLV) of your account on the close, in USD.

- The cash balance of your account, in USD.

- Equity of all stock and derivatives, equity index derivatives and mutual funds, with P&L (displayed as “PNL” in the report) in USD.

To use the report, click the radio button that corresponds to the up or down price change you want to see (+/- 3, 5, 10, 20 or 30%). The PNL for each position is updated by the selected percentage.

Certain positions are shown in the report but not valued under the stress scenarios of -30%/+30% changes in the underlying price. You must evaluate your own risk for these positions and include them in the totals provided.

The following figure shows an example of a Stress Test report, with -30% selected.

For more information